us germany tax treaty social security

A special provision applies for pensions and other similar remunerations paid by the government public subdivisions or local authorities in respect to services rendered to one of these official bodies Art. Tax purposes as if they were paid under.

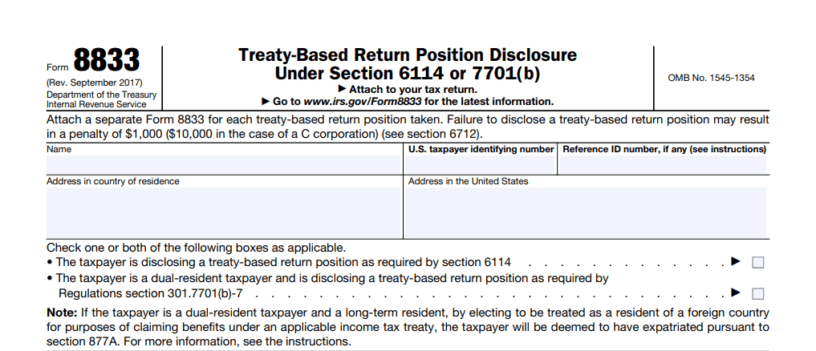

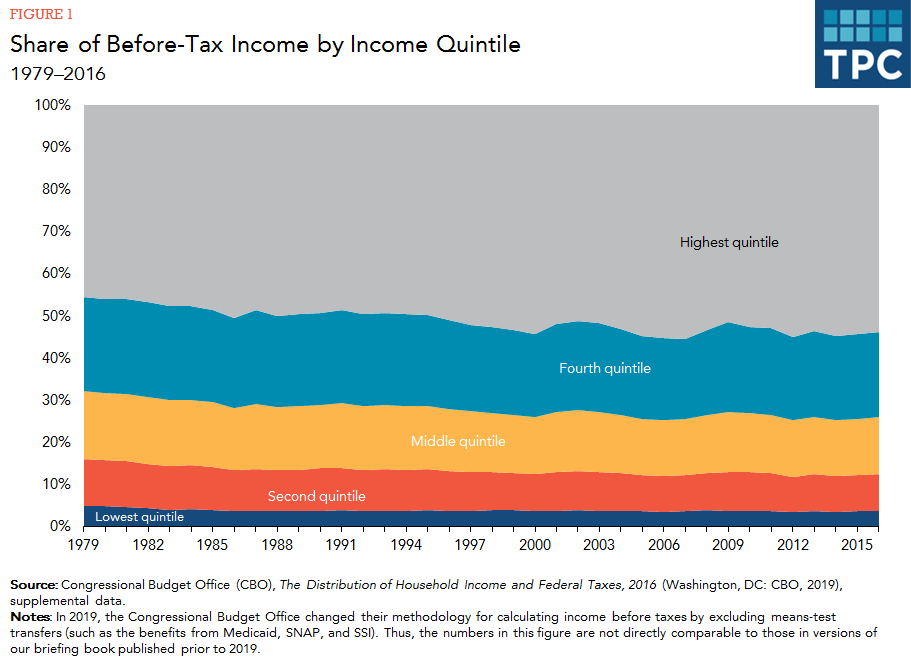

How Do Taxes Affect Income Inequality Tax Policy Center

Germany imposes a tax upon the transfer of property by inheritance or by gift.

. The rate of tax is graduated and varies with the nature of the relationship between the transferor and the transferee. Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital.

10 of the German Income Tax Act is also subject to limited income tax liability. Residents are regarded for US. According to the US - German Totalization Agreement Social Security benefit payments are taxable in the country in which you reside.

Aa the federal income taxes imposed by the Internal Revenue Code but excluding the accumulated earnings tax the personal holding company tax and social security taxes. The complete texts of the following tax treaty documents are available in Adobe PDF format. The US-Germany Totalization Agreement A separate agreement called a Totalization Agreement helps ensure that us expats in Germany dont pay social security taxes to both governments while their contributions made.

Yes if you did not pay tax on this income in Germany then this would be excluded from the income that was taxed by your foreign country of residence. To claim a provision in the United States Germany Tax Treaty other than claiming US tax credits expats should use IRS form 8833. Residents are treated for US.

Income tax purposes as if they were paid under the social security legislation of the United States. Income tax under a tax treaty you may be able to eliminate or reduce the amount of tax withheld from your wages. For purposes of the US-Germany tax treaty the municipal business tax is treated like an income tax.

The Convention further provides both States with the flexibility to deal with hybrid financial instruments that have both debt and equity features. If a person is assigned to work within Germany for 5 years or fewer by a United States company they will pay taxes into the United States Social Security system. There is an agreement between Germany and the United States regarding which country receives social security taxes when a person is working within Germany.

The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. These benefits will not be taxed in the US. If you receive social security benefits from Canada or Germany include them on line 1 of Worksheet 1.

For retirement the treaty also results in your German social security payments being taxed the same way as US. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

US-German Social Security Agreement. You must report your US. Should they be excluded when calculating the gross income for Form 1116.

Federal Income Tax FIT under a tax treaty by completing Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting and delivering it to the US. Should I enter the SSA-1099 info I received into TurboTax. Payor you may claim an exemption from withholding of US.

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. Under the tax equalization arrangement the employer pays both the employees foreign Social Security tax of US7000 plus the employees foreign income tax.

Provide your employer with a properly completed Form 8233 for the tax year. This means that if you are still living in Germany when you qualify for social security benefits you will not pay any US. The existing taxes to which this Convention shall apply are.

Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. If you reside in a foreign country and receive a pensionannuity paid by a US. Therefore my US Social Security benefits are taxable in Germany They are not taxable in the USA.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Estate and Gift Tax Treaty. Excepting this rule from the saving clause means that the United States may not apply the Code rules to tax its citizens resident.

Were living in Germany so US Social Security wages are nontaxable treaty article192. Benefit 8 What you need to know about Medicare 8. Under income tax treaties with Canada and Germany social security benefits paid by those countries to US.

In the Federal Republic of Germany this will include. 32 rows Foreign Social Security Tax Rate. A In the United States.

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in both countries. Social security income. 7000 multiplied by 72 5040.

And bb the excise tax imposed on insurance premiums paid. Employee--US7000 Foreign Marginal Personal Income Tax Rate. As of 2009 certain retirement income drawn from Germany within the meaning of 22 No.

As amended by a Supplementary Agreement signed at Washington October 2 1986 entered into force March 1 1988 and by a Second Supplementary Agreement signed at Bonn March 6 1995 entered into force May 1 1996. If you are not a student trainee teacher or researcher but you perform services as an employee and your pay is exempt from US. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US.

Germany - Tax Treaty Documents. The treaty provides that the distributions are taxed only in your country of residence. Agreement Between The United States And The Netherlands Agreement Between The United States And The Netherlands Contents Introduction 1 Coverage and Social Security taxes 2 Certificate of coverage 3 Monthly benefits 5 How benefits can be paid 7 A Dutch pension may affect your US.

5 Sentence 1 of the German Income Tax Act 49 Sec. Therefor US social security pension of US citizens living in Germany will only be taxed in Germany. 5 Paragraph 2 of Article 19 provides for the taxation of social security benefits only in the State of residence of the beneficiary.

The purpose of the Germany-USA double taxation treaty. 19 2 DTC USA. The Form 8233 must report your Taxpayer Identification.

I am a retired US citizen who is residing in Germany. Inheritance Gift And Wealth Taxes. And if you have moved back to the US.

Income Tax In The Uk And France Compared Frenchentree

Form 8833 Tax Treaties Understanding Your Us Tax Return

Social Security Taxes Expatrio Com

Even If You Are Still Young And Have A Long Career Ahead Of You You Should Not Neglect To Consider The Instagram Apps How To Find Out Buy Instagram Followers

Do Expats Get Social Security Greenback Expat Tax Services

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Even If You Are Still Young And Have A Long Career Ahead Of You You Should Not Neglect To Consider The Instagram Apps How To Find Out Buy Instagram Followers

Andalusia Closed 2021 With 8 200 Companies And 265 000 More Workers En 2022 Ley Segunda Oportunidad Bar Tribunales

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Www Steuben Schurz Org Cms Upload Downloads Usa Interns Tips Lettering Cover Letter

What Are The Types Of Monarchies Around The World Answers World Monarchy Festivals Around The World

Income Tax In Germany For Expat Employees Expatica

What Uk Tax Do I Pay On My Overseas Pension Low Incomes Tax Reform Group

How Do Taxes Affect Income Inequality Tax Policy Center

Can I Contribute To Social Security From Overseas

How Do Taxes Affect Income Inequality Tax Policy Center

What Small Business Owners Should Know About Social Security Taxes